Tax Prep

Comprehensive Tax Services That Go Beyond Mere Compliance

Our tax preparation services are comprehensive solutions that extend beyond compliance, ensuring accurate filings, optimized tax savings, and strategic tax planning to support your financial goals.

Personalized Tax Planning

Individual and Business Tax Returns

Tax Credits and Incentives

We uncover hidden financial opportunities from R&D initiatives, to energy-efficient practices and strategic hiring decisions. We transform overlooked items into significant tax savings, bolstering your bottom line and fueling growth.

Sales and Use Tax Expertise

We simplify the complexities of sales and use tax reporting, especially for multi-jurisdictional businesses. Our tailored approach ensures compliance, identifies savings, and adapts to your specific industry needs.

Proactive Tax Management

We handle your quarterly and annual filings with precision, providing real-time insights into your tax obligations. Our proactive approach ensures compliance, supports strategic decision-making, and keeps you informed year-round. Experience tax preparation that works for your business, not against it.

Continuous monitoring

We stay ahead of ever-changing tax codes, continuously monitoring and adapting to regulatory shifts. Our vigilance ensures your ongoing compliance and allows us to refine strategies that maximize your financial position.

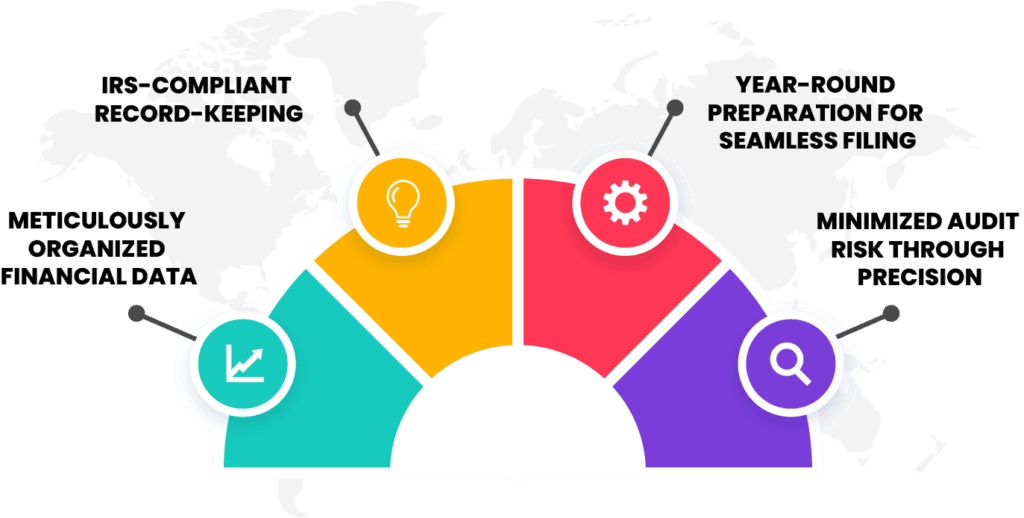

Tax-Ready Records: Simplifying Your Fiscal Year

Turn tax time into a strategic advantage with our proactive approach.

We take accuracy seriously. Each financial report undergoes a meticulous three-step review process, with final oversight from a certified CPA. This rigorous approach ensures the highest standards of precision and reliability in every aspect of our work.